Buying a new car is exciting — but don’t let excitement cost you thousands.

Over the years working in car sales, I’ve seen countless customers skip the fine print, rush the paperwork, and leave the dealership with hidden fees they didn’t realize they agreed to.

Don’t let that be you. Here are 6 things you must pay attention to before signing anything.

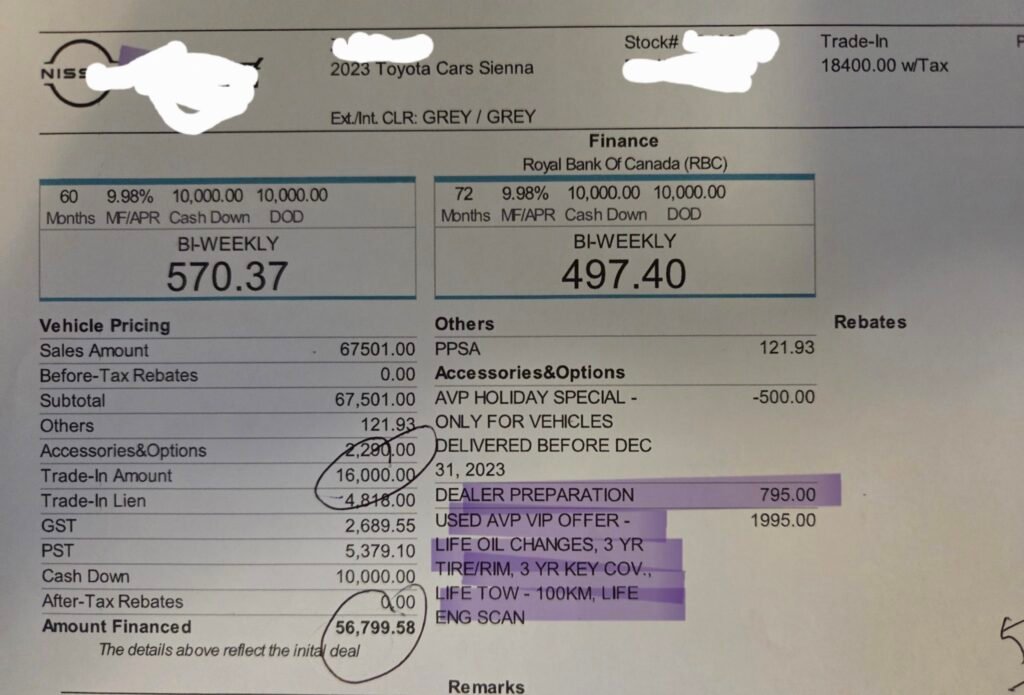

1. Read the Breakdown Carefully — Every Line

You’d be surprised how many customers don’t. They’re emotionally committed, the salesperson has built rapport, and the paperwork feels like a formality.

But that’s where fees hide: in the breakdown.

Take your time. Ask questions. Double-check everything before you sign.

2. Everything Is Negotiable — Yes, Everything

Dealerships often present fees as “standard” or “mandatory.” But the truth is: most fees are negotiable.

- Documentation Fee

- EV Tire Levy

- “Go Green” Environmental Fees

- Security/Etching/Vin# Protection

- Nitrogen Tire Fill Fee

If you don’t challenge them, they stay on your bill.

3. Never Get Sold on Monthly Payments Alone

This is the oldest trick in the book: distract the customer with a “low monthly payment” while slipping in extras.

Don’t fall for it.

Negotiate based on OTD — Out-The-Door — price. That’s the real price after taxes, fees, and everything. Once that’s locked in, then and only then should you talk about financing or leasing.

4. Always Keep a Copy of What You Sign

Sometimes you’ll find out about a fee only after reviewing the paperwork at home. If you signed something you didn’t agree to or weren’t clearly told about — you can still raise a complaint if you kept your documents.

But your best defense is being alert upfront.

5. You Don’t Need the “VIP” or “Value” Packages

Managers love adding “VIP” or “Value” packages with tint, mats, tire warranty, paint protection, etc.

These packages can all be declined — they’re not required to complete your purchase.

Even if you want one of the services later, you can always buy it separately at market value. Don’t let anyone pressure you into bundled markups.

6. Compare Offers. Always.

Here’s the truth: some dealerships offer better deals than others. Some waive fees, some discount below MSRP, and some will go the extra mile to earn your business — especially if they know you’re shopping around.

That’s where GettingDeal.com helps.

We contact all your surrounding dealerships for you. Then we email you a full breakdown of what each dealer offers — real numbers, no pressure. When you’re ready to buy, we connect you to the one you choose.

No sales calls. No surprise fees. No wasted weekends.